Program Info

Our door is always open.

Story

We offer women small loans starting from $500 up to $2,500* for first-time borrowers to start or grow their small businesses. Members can receive larger loans following successful completion of each six-month loan cycle.

What are the loan terms?

No application fees

Interest rates vary by location*

A six-month loan term

No collateral or credit history is required to qualify for a loan from Grameen America

I am a woman who wants to start or grow a small business

I am looking to join a supportive peer network of women building businesses in my community

If both statements apply to you, you are eligible to apply!

*Loan amounts and interest rates vary by location. Please speak with your Elevate by Grameen America representative for more information.

Am I eligible?

Member Journey

How to Join

1

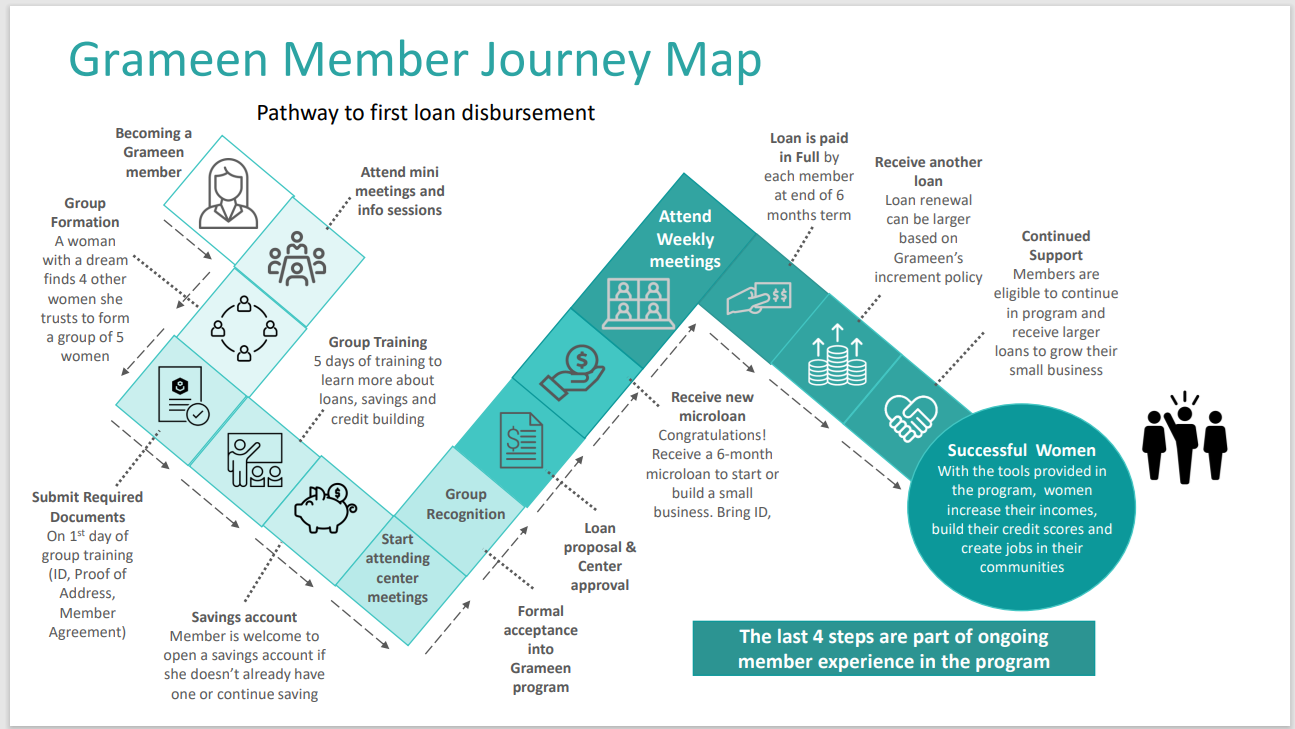

1. Group Formation

Form a group with four women you trust.

There is a four-step process to join Grameen America: Group, Onboarding, Verification, and Weekly Meetings. The total time commitment for onboarding can take two to four weeks. It all depends on the members, group, and branch staff. All members must demonstrate and acknowledge commitment to our program before receiving their loan funds.

The Elevate 4-Step Process

2. Onboarding

You will begin your Grameen onboarding with Continuous Group Training (CGT) as a group. During CGT, you will learn more about our program model and provide physical copies of your documents.

3. Verification

Invite a member of our Grameen team to complete a home or business verification visit.

4. Weekly Meetings

Meet virtually weekly with your group and Grameen America staff to make loan payments, continue your education and build peer support networks.

Member Profiles

Meet the superwomen changing the face of entrepreneurship and elevating their financial futures

Join the Movement

Grameen America Inc. is required to be licensed in certain states due to its loan operations.

LOANS IN NEW YORK ARE MADE PURSUANT TO ARTICLE 9 OF THE NYS BANKING LAW, SECTIONS 340-361 MAIN LICENSE NUMBER LL103768; CALIFORNIA PURSUANT TO THE CALIFORNIA FINANCE LENDERS LAW, DIVISION 9 (COMMENCING WITH SECTION 22000) OF THE FINANCIAL CODE. THAT LICENSE IS ADMINISTERED BY THE CALIFORNIA DEPARTMENT OF FINANCIAL PROTECTION AND INNOVATION, MAIN OFFICE LICENSE NUMBER 60DBO35876. FOR INFORMATION OR COMPLAINTS, CONTACT THE DEPARTMENT OF FINANCIAL PROTECTION AND INNOVATION, STATE OF CALIFORNIA AT 1-866-275-2677 OR WWW.DFPI.CA.GOV; THE STATE OF NEBRASKA PURSUANT TO THE NEBRASKA INSTALLMENT LOAN COMPANY ACT AND THE STATE OF TENNESSEE UNDER ITS RESPECTIVE FINANCE LAWS.